1.

Background

Market linked pensions are a particular form of account based pension. They are constructed under regulation 1.06(8) of the Superannuation Industry (Supervision) Regulations. Market linked pensions are also sometimes known as term allocated pensions.

The required annual draw-down from these pensions is calculated by dividing the pension balance at the start of the financial year by a factor that varies with the remaining term of the pension. The actual draw-down must then normally be within 10% of that amount. The rules for these pensions are designed to progressively draw down the pension account balance over its full term, so that the balance is exhausted when the end of the term is reached.

When a market linked pension is commenced, the trustee must select a term for the pension, based on the rules in the Superannuation Industry (Supervision) Regulations.

From 20 September 2007, a market linked pension cannot be commenced using a member’s accumulation balance. It can only be commenced by commuting and re-starting an existing complying pension, such as another market linked pension or a defined benefit pension.

2.

Rules for Market

Linked Pensions

The comments below provide more details about the rules applying to market linked pensions. These comments focus primarily on the rules for selecting the term of a market linked pension and calculating the annual pension draw-downs. There are other important rules regarding market linked pensions (for example, regarding how they are taxed and their transfer balance cap implications) that are outside the scope of this article.

2.1.

Term of a Market

Linked Pension

When a market linked pension is commenced, the

trustee must select a term for the pension,

based on the following constraints (for a

pension that is non-reversionary) calculated on

the commencement date of the pension:

a) The term cannot be less than the member’s life expectancy in whole years, rounded up.

b) The term cannot be more than the greater of:

-

The member’s life expectancy in whole years, rounded up, as if the member was 5 years younger; and

-

100 minus the member’s attained age.

For a pension that is reversionary to the

member’s spouse, the member can choose to use

either their own life expectancy or (if the

spouse’s life expectancy is greater) the life

expectancy of the spouse when applying the

constraints in a) and b) above.

The rules summarised above are those applying to

market linked pensions started on or after 1

January 2006.

Slightly different rules applied to

market linked pensions started before that date.

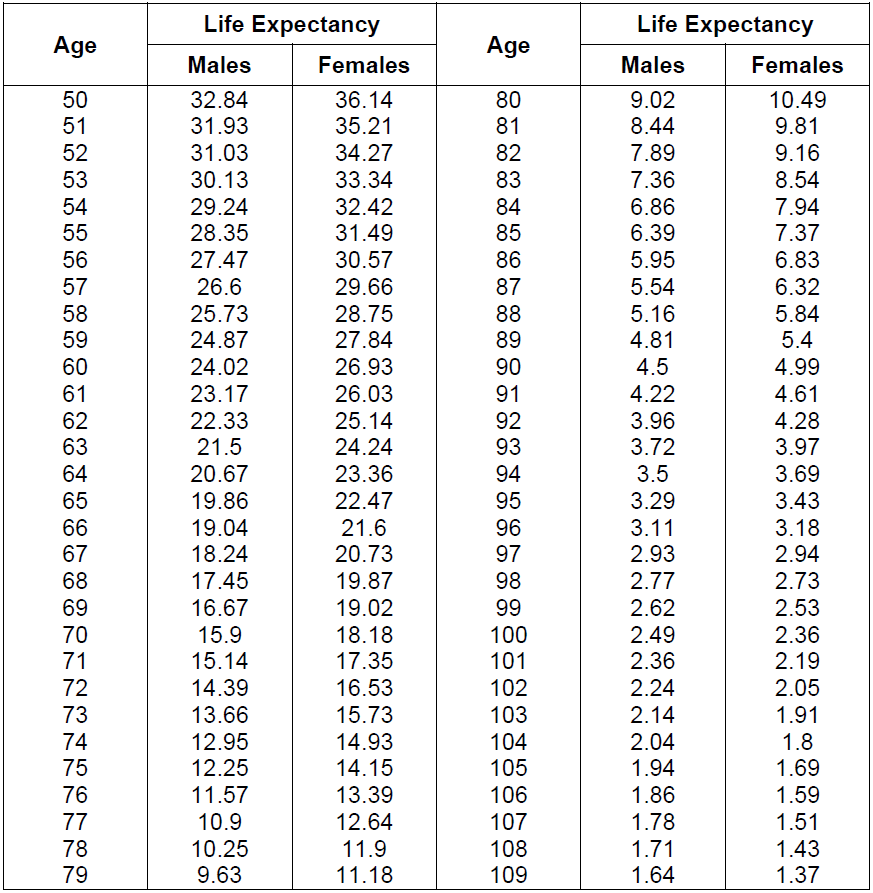

For a market linked pension commencing on or

after 1 January

2020, the life expectancy of the member and

the spouse should be calculated using Australian

Life Table 2015-2017, published by the

Australian Government Actuary.

An

extract of this table of life expectancies (from

age 50) is reproduced below.

Different life tables applied to market linked pensions starting in earlier periods. If the Australian Government Actuary publishes new life tables, then the life expectancies used for market linked pensions may also change for future periods.

2.2.

Market Linked Pension

Payment Factors

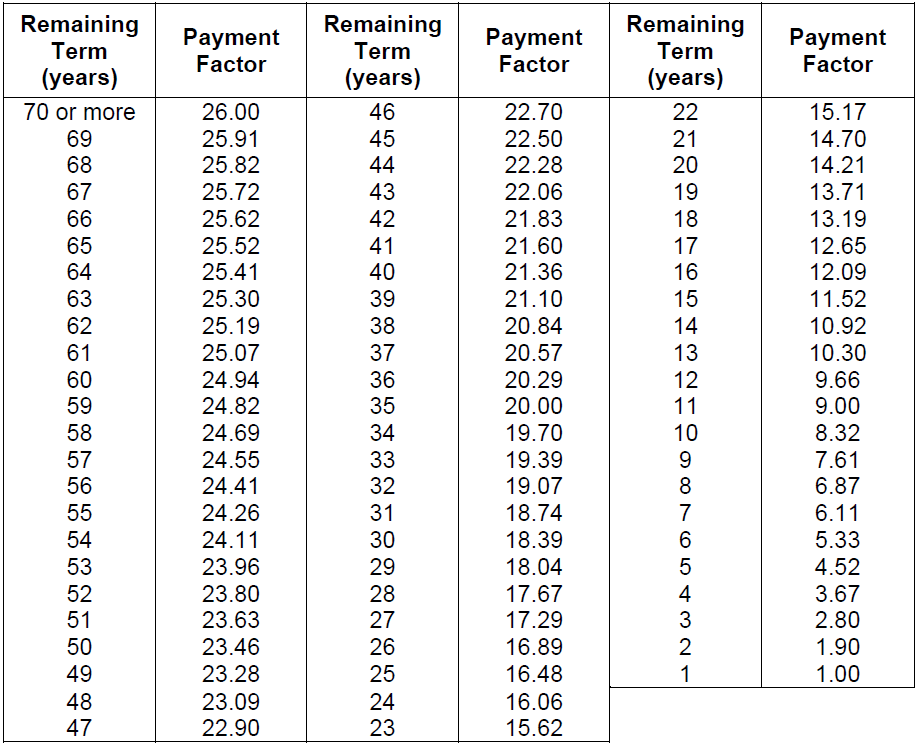

The table below sets out

the payment factors applying to market linked

pensions.

At the start of each financial year (or

on the commencement date of the pension), the

remaining term of the pension (rounded up if the

commencement date of the pension was on or after

1 January in the financial year and rounded down

if the commencement date was on or before 31

December in the financial year) is used to

determine the payment factor for that year.

The annual payment

amount is then determined by dividing the

payment factor into the account balance of the

pension at the start of the financial year (or

on the commencement date of the pension, in its

first year).

The amount calculated is also rounded to

the nearest $10.

The actual draw-down in

a year must normally be within +/- 10% of the

calculated payment amount.

For market linked pensions that are started on

or after 20 September 2007, the draw-down in a

year also cannot be less than the age-based

minimum payments required for an account based

pension (see

the article

Minimum Drawdowns for Account Based Pensions

for more information).

This has the potential to create conflicting

requirements if the age-based minimum payment

for an account based pension is greater

than the maximum payment amount as

determined above.

In this case, it may be necessary to

commute your market linked pension and

re-commence it with a shorter remaining term.

The information provided in this document is not financial product advice. It does not take into account your specific

circumstances or needs. While Verus SMSF Actuaries has taken care to ensure that the information is accurate

you should seek appropriate professional advice before acting on any of the information provided.

Updated November 2024